Trend – Indian retail Fit-Out industry

The Indian Retail Market is growing at a 12 percent CAGR. Meanwhile, organized retail in India is surging ahead at a CAGR of 32 percent (PwC report “Building retail businesses for tomorrow today”). This growth is owing to the combined increase in both online and offline channels.

© Surender Gnanaolivu

This progression in the offline space has impacted the increase in the demand of fit-out elements. There isn’t just a growing demand for more quantity but also for quality designed to keep the new-age consumer inspired, engaged and loyal. With more international brands coming in, the bar has been raised and the Indian Fit-Out industry has quite literally stepped up to ‘deliver the goods’!

Over the past six months, VM&RD assessed the main Fit-Out categories (comprised of Mannequin, Lighting, Graphics & Signage, Fixtures and VM Props) with focused special editions and insightful chats with over 100 top Retail Service Providers (RSP), who manufacture and supply fit-out equipment in India. We now take an overall look at the Fit-Out industry to take a snapshot of trends and its performance, based on compilations of data and information from the previous financial year of 2016-17.

Highlights of the compilation and analysis

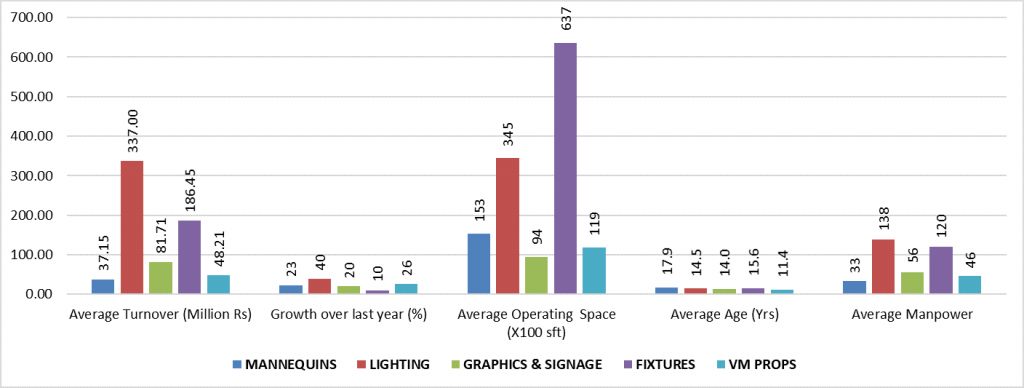

- The average age of Fit-Out industry categories is about 15 years, with the oldest being Mannequins at 18 years and the youngest being VM Props being 11. The remaining categories seem to stem from nearly the same time, averaging at 14 years.

- The overall amount spent by the organized sector of the top 100 RSPs is about 1,550 Cr Rs with an average CAGR of about 24 %. The highest average turnover is attributed to the Lighting category at 337 million Rs (33,7 Cr Rs), followed by Fixtures at 186 million Rs (18,6 Cr Rs).

- A major percentage of the 3,600 clients who are serviced stem from the traditional retail segment. They contribute between 50 and 80 % of the total number of projects, but the average billing from each is less than one-fourth of that contributed by clients from the organized retail sector. The highest number of clients is in the Mannequin Industry at over 1,250, followed by VM Props at about 900, owing to the demand of these categories from the traditional retail segment.

- The overall operating space occupied for Fit-Out manufacturing amounts to nearly 3, 2 million square feet, with the highest average operating space occupied by the Fixture category at 63,700 square feet, followed by Lighting at 34,500 square feet. Interestingly, the Mannequin category requires the least amount of area despite the fact that it manages the highest number of clients.

- The top 100 RSPs in the Fit-Out industry employ over 9,000 skilled staff members, with the highest average members of staff being attributed to the Lighting category at 138, followed by the Fixtures category at 120. Again, the Mannequins category is the lowest at 33.

- Finally, in terms of revenue productivity to operating space, the Lighting category comes in on top at close to Rs 10,000 per square foot, followed by the Graphic & Signage category at close to 9,000 per square foot. Lighting leads again in people productivity at a high of about 2, 43 million Rs (24,3 Lacs Rs) per person employed! This is followed by the Fixture category at 1, 55 million Rs (15,5 Lacs Rs).

- Overall data shows that Lighting leads in turnover, growth, and productivity. It is not surprising that it monopolizes the supply for Indian and international retailers operating in India and indicates that it has met global standards earlier than the other categories. The Fixture category follows closely, holding close to a supply monopoly in India with Chinese suppliers still being serious competitors in terms of quality. The other categories are also improving steadily.

© VM-RD Magazine India

Overall, from the RSP’s perspective, it’s been a good CAGR in terms of revenues, more opportunities, growing revenues and increasing efficiencies of operations (in terms of space and people). From the customers’ perspective, benefits include the availability of globally comparable quality, better price, and choice. We can therefore confidently conclude that the Indian Fit-out industry offers an encouraging win-win position for both the buyer and the seller.

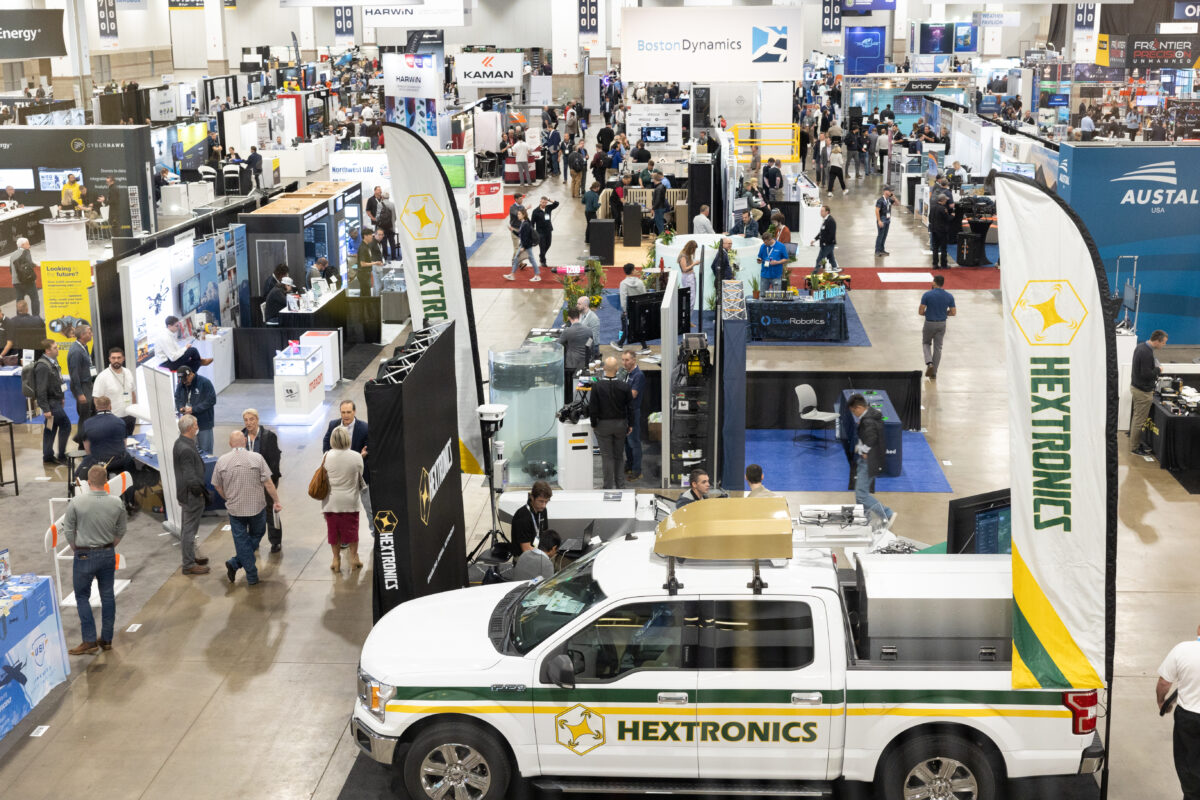

In-store Asia 2018 features all the top RSPs in the Fit-Out categories, which present many new ideas that will substantiate these findings. We look forward to seeing you at the largest retail trade fair in the Indian subcontinent that focuses on retail Fit-Out and in-store marketing.

Author: Surender Gnanaolivu