Payment must be simple!

Oliver Lohmüller-Gillot from First Data talks about developments in retail.

Mr. Lohmüller-Gillot, what are the main technology trends in ecommerce and cashless payment today?

Technology has reinvented commerce. It changed what consumers expect to experience in physical retail and foodservice outlets. It opened the door to new ways of engaging with brands across the path to purchase. It altered the role the payments industry plays in the transaction.

Today, consumers are able to more easily control how, when and where their cards are used when accessing their card issuer’s mobile banking app. Consumers also can remotely deactivate cards or set spending controls at the device level.

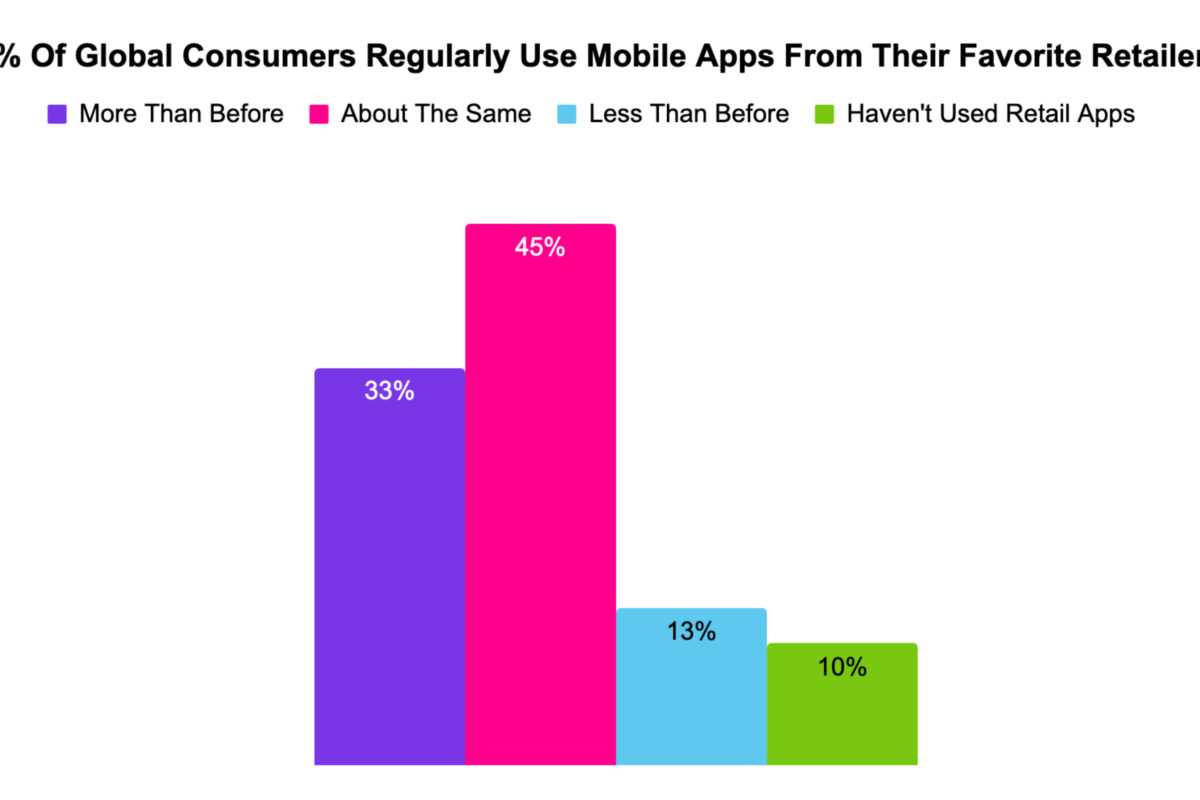

Moreover, apps are what’s accelerating mobile adoption. The overarching aim of apps, no matter their function, is to help make the lives of consumers easier. A few years ago, we used to never leave the house without our wallet and phone. Now, thanks to payment apps, all we need are our phones. Apps are what’s really driving mobile device adoption.

Also, solutions such as Apple Pay and Google Pay, recent additions to the German market, have led to an environment where it is easier than ever to connect with the world at large, and pay in-app, on the go and even through the use of social media profiles.

U-Commerce, the secure end-to-end commerce and customer engagement solution, helps our clients provide a seamless, omnichannel purchasing experience and value added services via any purchasing channel.

How can retailers find out which payment methods their customers prefer?

From hardware to software, from cash registers to digital wallets, retail is changing, especially as mobile makes inroads into the way we pay.

In parallel, consumers are demanding greater access to information, offers and payment functionality anytime and anywhere, and the lines between in-store commerce, eCommerce and mobile commerce are blurring. Consumers are more and more asking to pay contactless, whether it is via credit card, debit card or girocard, as well as Google and Apple Pay.

As more and more people depend on payment options other than cash while shopping, it is critical for businesses of all sizes to have a convenient and reliable POS (point-of-sale) system.

What are you presenting at EuroCIS 2019?

First Data continues to advance U-Commerce for consumers, merchants and financial institutions through products and enhancements highlighted at EuroCIS. These innovations are both providing consumers with exciting new ways to interact at the point of sale as well as enabling our merchants to streamline and automate some of their business operations.

Interview: EuroShop.mag