Mergers and acquisitions continue to be a key trend in the convenience store channel

There are 153,237 convenience stores operating in the United States, a 1.1 percent decline from last year’s record of 154,958 stores, according to the 2019 NACS/Nielsen Convenience Industry Store Count. The count is based on stores as of December 31, 2018.

The decrease in stores was fueled by a 2,198-store decline in single-store operators, which still account for 62.3 percent of all convenience stores (95,445).

The convenience store count accounts for more than one third (34.4 percent) of the brick-and-mortar retail universe tracked by Nielsen in the United States. Except for the dollar store channel, all other major channels had fewer units at year-end 2018:

- Convenience store: 153,237 units total in 2018; -1.1 percent decline

- Grocery store: 49,842 units total in 2018; -2.5 percent decline

- Drug store: 41,833 units total in 2018; -3.1 percent decline

- Dollar store: 31,620 units total in 2018; 4.1 percent rise

- All other brick-and-mortar stores: 169,107 units total in 2018; -1.3 percent decline

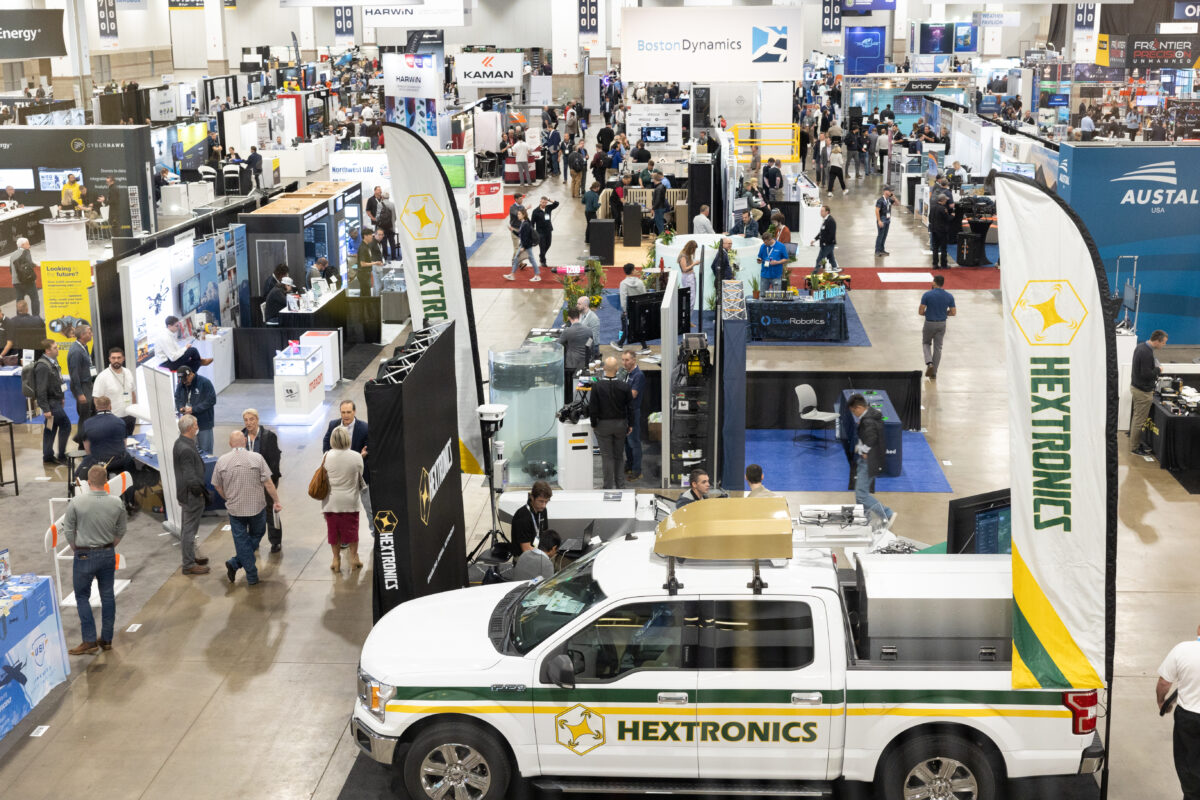

A key trend within the U.S. convenience and fuel retailing industry continues to be strong mergers and acquisitions activity, particularly among existing convenience store chains. Like 2017, the industry experienced historically large M&A deals in 2018, but also saw new entrants to the U.S. market from global companies based in Chile and the United Kingdom, for example.

“With expanded competition for the convenience customer and an active M&A environment, retailers increasingly need to up the ante on delivering a quick and exciting shopping experience by investing in their core offer of convenience. With one in seven stores getting remodeled every year at a cost of $400,000, that can put pressure on some stores whether to modernize operations or exit the business,” said NACS Vice Chairman of Research Andy Jones.

Consumers are redefining what convenience means to them, and as a result, today’s retailers must be extremely tuned into the wants and needs of the individual consumer,” said Jeff Williams, senior vice president of retail services at Nielsen. “Convenience players will need to continue to seek growth opportunities amid a fiercely aggressive environment, whether that’s through exploration of frictionless payment methods, piloting more efficient retail layouts, expanding private label programs, increasing food service offerings, or a move toward building an omnichannel presence. That said, as the value of convenient shopping experiences continues to grow in importance, convenience as a channel must play into its true strengths and optimize to be the retail channel that best serves the needs of on-the-go consumers, on a personal level.”

Source: NACS