E-commerce helps stabilize German economy

by Elisa Wendorf (exclusively for EuroShop.mag)

The COVID-19 pandemic and associated crisis situations in many countries also leave their mark in German foreign trade this year. Added to this are the implications of Brexit, which are likewise a challenge for German companies as was shown by the results of a recent business survey conducted by Germany’s DIHK Chambers of Industry and Commerce. DIHK surveyed 2,400 internationally active German companies.

All told, only two out of five (17%) of German companies expect better foreign business in 2021. Infection protection and control measures amid the coronavirus pandemic place restrictions on supply chains.

Travel restrictions and lower demand

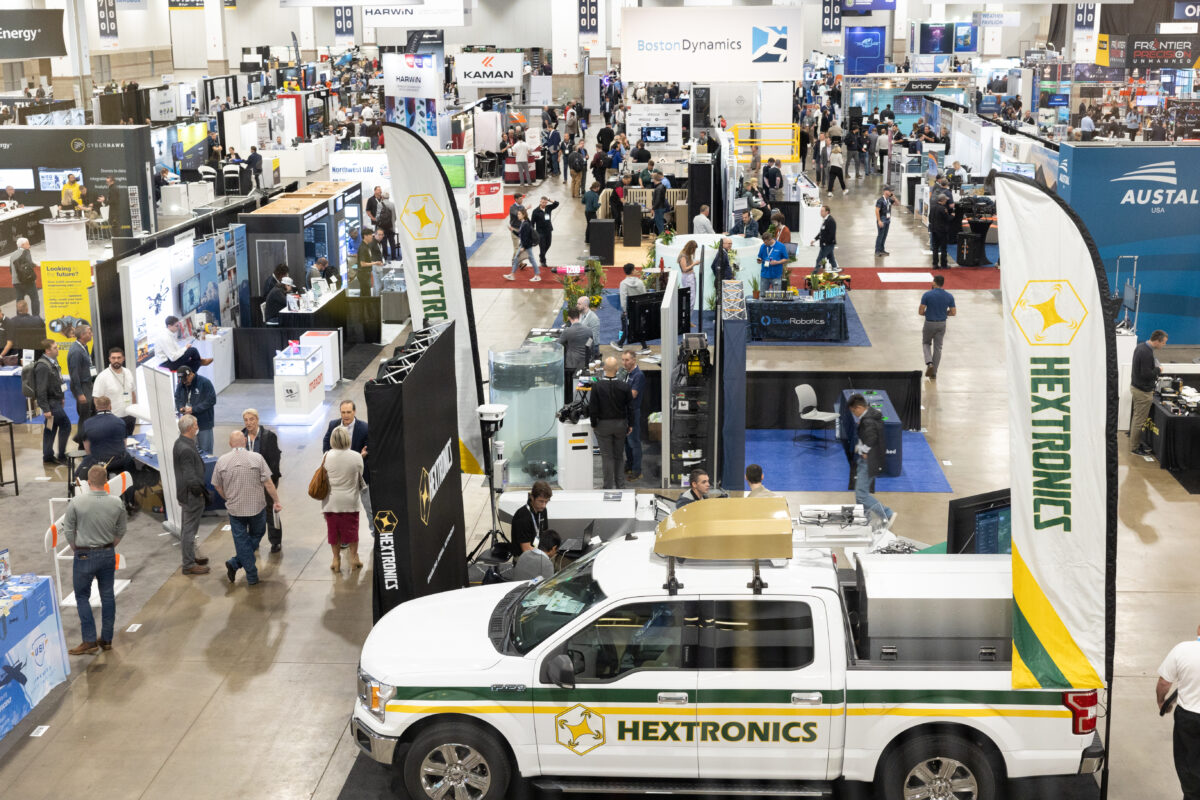

About three-fourths of German businesses are affected by travel restrictions. Nearly seventy percent of companies are challenged by the cancellation of trade fairs and events. Almost half of the survey participants are experiencing less demand for their products or services, while one-third report cancellations of orders. This results in companies increasing their stock and postponing investments. About 40 percent of foreign-active companies have problems in the supply chain or logistics, especially as it pertains to the Eurozone, in trade with China and with the UK. The latter comes with drastically reduced export prospects thanks to the consequences of the UK’s exit from the EU single market. The outlook is also somewhat bleak when it comes to emerging and developing countries.

To compensate for production downtimes and restrictions in delivery traffic, two-thirds of companies with supply difficulties are planning to change their supply chains.

Global trade barriers are not just a phenomenon of the COVID-19 pandemic. While 32 percent cited increasing global trade barriers in 2017, the percentage rose to 47 percent in 2019. The following year, every second company reported an increase in trade barriers, though the number decreased to 47 percent this year. Besides the restrictions resulting from the coronavirus pandemic, there are subsequently numerous other trade barriers in international business relations.

More than half of German companies feel confronted with increased safety requirements. Almost every second company faces obstacles to international business because of local certification requirements. Additional testing of products or internationally unusual safety regulations cost companies precious time and money.

Brexit and its impact on German companies

A special evaluation of the IHK Business Survey asked about 1,500 German companies which are engaged in trade with the United Kingdom about the impact Brexit had on their foreign operations.

© PantherMedia/InkDropCreative

The Trade and Cooperation Agreement between the United Kingdom and the European Union has been in place since January 1, 2021. Among the biggest changes for foreign business in the UK are new customs declarations and customs controls in cross-border goods traffic. The DIHK estimates that German companies will have to submit around ten million customs declarations per year in the future.

Three out of four companies view the expected additional customs bureaucracy as a big business risk – this includes logistics problems, legal uncertainties, and additional burden on customs agents and service providers.

The United Kingdom was Germany’s fifth-largest trading partner in 2017 yet dropped in ranking to number seven just four years later. The trade volume between Germany and the United Kingdom amounts to 102 billion euros.

German export volumes to the UK have collapsed since the 2016 Referendum. Nearly 750,000 jobs in Germany depend on this trade.

Apart from the US, the UK is the second largest destination market for German investment in the world – to date, German companies have built up investments worth over 160 billion euros to date in the United Kingdom and maintain about 2,500 branch offices in the UK, which employ nearly 400,000 workers.

As a result, German companies lack confidence in their British business relations at present, with three out of five companies rating their current business situation in the UK as poor. More than half of German businesses expect a continuation of this negative trend.

Despite barriers, the German e-commerce market is growing

Yet despite all difficulties, business does not grind to a halt. The COVID-19 pandemic has drastically boosted online sales. According to a study by the German E-Commerce and Distance Selling Trade Association (bevh), online retail notably promotes innovation and supports Germany’s economic performance. E-commerce is becoming more and more relevant in the B2B sector: B2B e-commerce revenue in Germany was nearly four times larger than direct-to-consumer sales revenue. German companies also profit from international e-commerce: gross domestic product increases thanks to online shopping within and between EU countries.

Detailed information by DIHK on what companies need to consider in future economic relations with the UK can be found here.

The government of the United Kingdom also provides guides to importing and exporting between Great Britain and mainland Europe.

Countries that are getting a grip on the COVID-19 pandemic have started to host business events such as trade fairs again. One way to boost weakened foreign business is to participate in foreign trade fairs and events. Small and medium-sized German enterprises are encouraged and financially assisted by the German Federal Government with foreign trade fair participation programs. For example, Germany companies can use these funds to take part in the C-star 2021 in Shanghai – the International Trade Fair for Solutions and Trends all about Retail.