How European retailers are attracting Asian customers thanks to Alipay+

By Katja Laska (exclusively for EuroCIS.mag)

The new online payment platform Alipay+ joins forces with Thunes, a provider of cross-border payment options. Thanks to the partnership, merchants in Europe that collaborate with Thunes can accept Asia’s most popular mobile wallet payments during checkout.

In this interview, Jun Cai, Business Development Manager for Alipay+ in Germany, Austria, and Switzerland, talks about the benefits this offers the respective retailers, explains what merchants must consider in this setting and reveals why “mobile first” may already be outdated in Asia.

How do the European and Asian payment markets differ and where do you see weaknesses?

© Ant Group

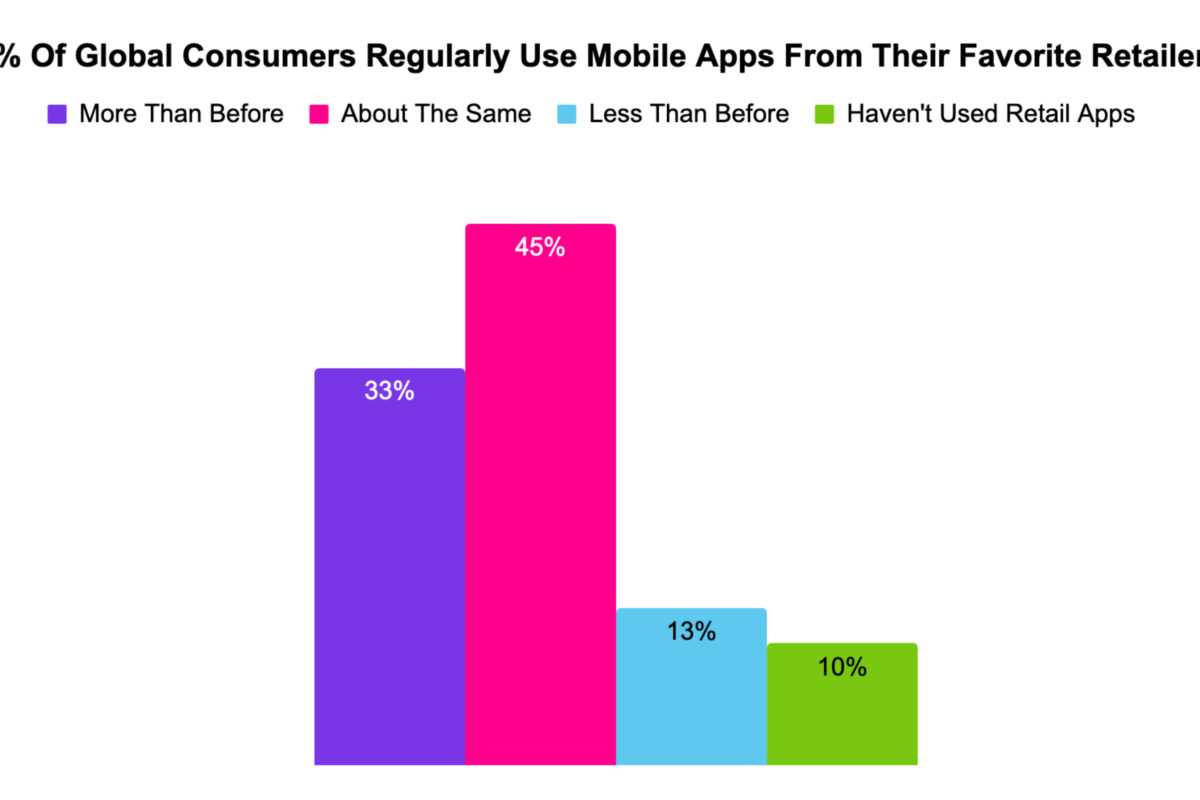

Jun Cai: Just a few months ago, a Statista survey confirmed that Asia is steps ahead of Europe when it comes to the use of mobile payment solutions. Over 40 percent of all transactions made at the point of sale in Asia were completed via mobile wallets – ahead of credit cards and even cash as options. Meanwhile, in Europe, only 8 percent of POS transactions are carried out using mobile payment solutions.

China is a pioneer in this area, isn’t it?

China has one of the highest penetration rates of any country. For over 80 percent of China’s population, using mobile payment solutions has become second nature as they rarely use credit cards or cash. In Germany, only 30 percent of consumers use these options. In China, people typically use one platform versus multiple apps to search for products – like the nearest pizza delivery service – all the way to payment services. Unlike Germany, China and Asia have moved from a “mobile first” to a “mobile only” environment.

Why do we need cross-border payment systems today?

Innovative solutions for cross-border payments help retailers to tap into and optimize the enormous market potential of their customers from the Far East. The “Made in Germany” seal of quality is regarded highly with Asian consumers, and it mutually benefits both sides:

- By offering their preferred payment method, retailers further simplify the buying process for customers, thus increasing the likelihood of a purchase decision.

- By integrating a cross-border payment solution, customers from Asia can pay with Alipay+, which is something they are familiar with using at home.

- The payment options retailers offer quickly become a key purchasing criterion for customers as they choose a retail outlet.

Are you interested in the latest payment solutions for mobile commerce? Then come to EuroShop 2023 in Düsseldorf and get to know the diversity of the Dimension Retail Technology. A visit is worthwhile!

© Ant Group

Do customers prefer multiple payment options?

Like I mentioned earlier, Chinese consumers rarely use credit cards or cash to make a purchase. Asian customers are very loyal to one platform. Once they have chosen one of the leading platforms – examples include the one-stop digital lifestyle platform Alipay – they will stay there.

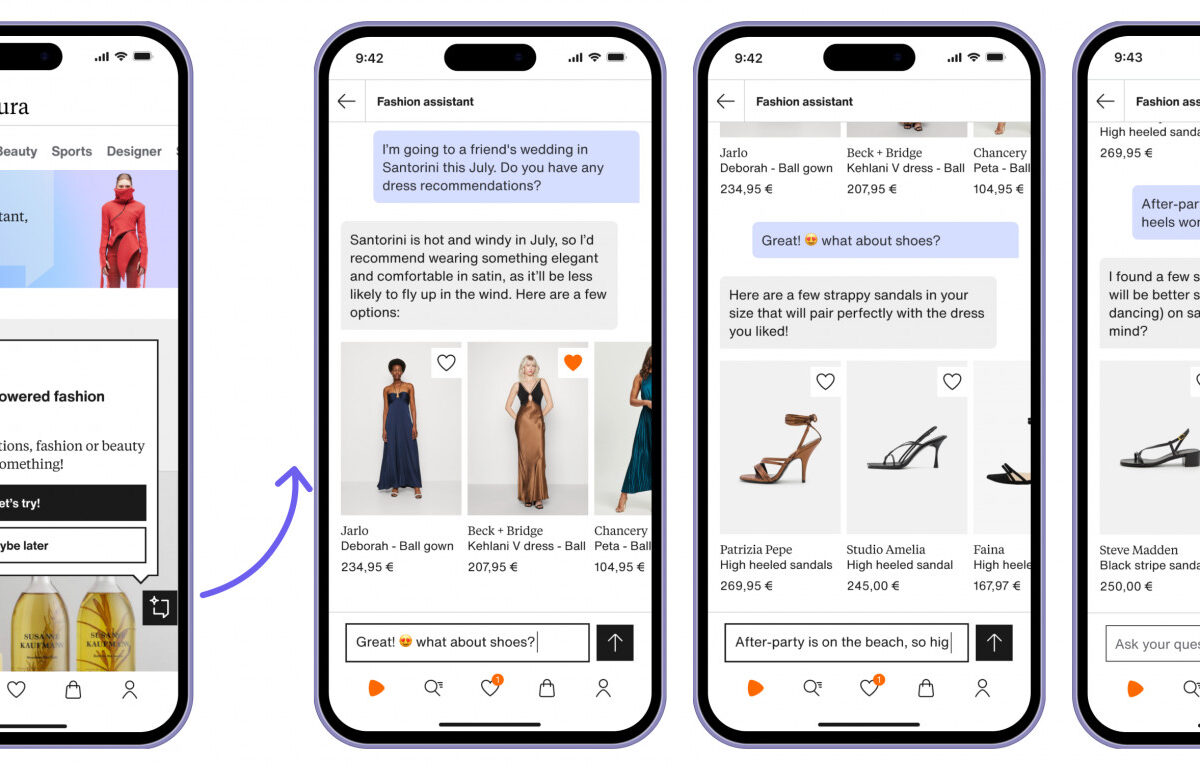

How is the solution integrated at Alipay+ and what do European merchants have to take into account if they want to use it?

Integration is done through Alipay+ acquiring partners such as Thunes, epay, and Worldline. For example, epay has integrated Alipay+ to support in-store cross-border mobile payments at the Müller drugstore chain (Drogeriekette Müller) in Germany. Retailers who have integrated the POS software of Alipay+ acquiring partners or use POS terminals of these acquiring partners can easily add Alipay+ as an additional payment method. There is no need for any added hardware.

How does the payment process work for customers?

Customers from Asia who want to pay with Alipay+ at a participating retailer simply open the respective Alipay+ QR code on their smartphone in their preferred e-wallet – examples include AliPay Wallet from China, GCash e-wallet, or South Korea’s Kakao Pay. The cashier scans the code, and the payable amount is subsequently displayed right in the app. The customer then accepts and confirms payment on his or her smartphone. Both the customer and retail cashier receive a transaction confirmation right away. Another option is for the POS terminal to present a QR code the customer can scan to trigger the payment process.