How do other countries take advantage of mobile payments compared to Germany?

by Katja Laska (exclusively for EuroShop.mag)

Kenya has M-Pesa, while Denmark, Finland, Norway, and Sweden prefer the “Mobile Pay” app. Since 2016, the latter also features the P2P application “Swish”, which makes it possible to transfer money in real time between smartphones. But what about Germany? We asked industry experts how Germans fare when it comes to mobile payment, learned about the challenges, and found out how other countries tackle this issue.

Nearly 25 percent of German citizens use mobile payment services, while 57 percent plan to use their mobile devices to make payments in five years’ time. Fifty-nine percent are certain that these services make shopping easier. These are the findings of PwC, one of Germany’s leading auditing and consultancy organizations from a mobile payment survey with 1,000 German participants. Cash is still king for a large majority of German consumers. Yet there are many mobile payment alternatives, as Caroline Coelsch, online & mobile payment expert from the EHI Retail Research, tells us:

As you can see, consumers have many options to choose from. But that might actually be one of the problems of the mobile payment landscape in Germany. Steven Jacob, Director and Managing Partner at Arkwright Consulting, believes that too many cooks spoil the broth: “Our banks are not always on the same page. We have a relatively heterogeneous landscape, with nearly 1,700 different types of banks, split into three groups: Savings banks (Sparkassen), credit cooperatives (Volks -und Raiffeisenbanken), and public sector commercial banks (private Banken). It can take many years for all of these institutions to join forces and decide on a solution if it happens at all. Banking is a competitively oriented industry sector in Germany, which tends to focus on its own solutions and approaches.”

A view over Germany’s borders

Steven Jacob, Director and Managing Partner, Arkwright Consulting // ©Arkwright Consulting

True to the motto “different countries, different cultures”, some nations take a different approach. Nordic countries like Finland, Sweden, Denmark, and Norway are leading a shift towards “cashless societies”. “The number of card payments in Germany today (pre-Coronavirus) corresponds to the quantities these countries already exhibited by the late 1990s,” explains Jacob.

Yet it’s not just consumers in highly developed and digitally advanced countries that make virtual payments. Even in Kenya, Africa, people have stopped using cash for some time now. Since 2007, M-Pesa has revolutionized the way people spend, save, and send money to others. As you might imagine, everything hinges on mobile phones. However, Kenyans don’t need to download an app on their smartphone because M-Pesa uses the mobile phone like a wallet. The SIM card or phone account can be repurposed into a bank account for “virtual currency” (that’s a fancy word for a digital account balance). M-Pesa can also be used to pay rent or utilities and to send money to third parties, and it all works via text message. The service has also become popular in Tanzania, Afghanistan, the Democratic Republic of the Congo, India, and Mozambique. In light of the lack of banks in Kenya and with the distribution of cash not being a feasible option, the service was born of the United Kingdom’s Department for International Development’s necessity to give rural areas a helping hand with microcredits. By now, it has become a run-away success. In 2017, 1.7 billion transactions were processed over M-Pesa, with a transaction volume of nearly 29 billion euros.

The move away from cash had a different trajectory for countries in northern Europe. “Banks in these countries have learned to collaborate, resulting in a comprehensive, standardized mobile payment system that benefits all citizens,” says Jacob. Although German banks have taken a different approach (to date), this is not the only distinction Jacob discerns. “Another aspect is the lower risk aversion of these countries, meaning they are more comfortable with trying new things and are willing to test digital options. These countries are also not quite as anxious about data protection concerns. One example of this is Sweden. Since 1766, the country’s constitution includes the principle of public access to official records. As a result, Swedes are familiar with public access to information, allowing them to legally publish and read public documents – with the exception of health records or information about the Swedish Secret Security Service. If you have learned over centuries that data protection is not as paramount, you take a different approach to loyalty programs, mobile payment, and digital identity schemes.”

Caroline Coesch also sees data concerns as one of the top issues in this setting:

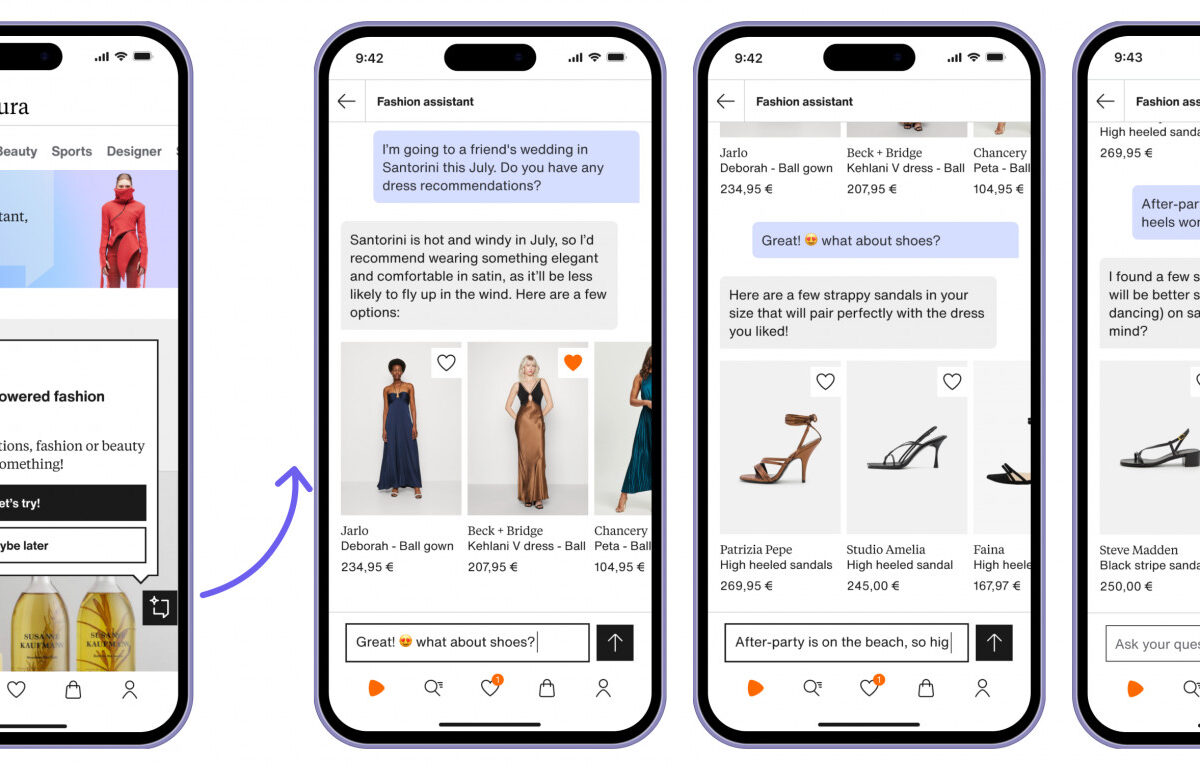

Despite some skepticism, both experts acknowledge possible ways to make mobile payments more attractive to consumers. Jacob uses the term “critical mass” in this context and explains, “There is no point if the customer has a payment-enabled smartphone if businesses don’t accept mobile payments. And vice versa: Why should retailers offer mobile payment options when consumers only prefer to use cash? You need a critical mass to crack the chicken or the egg causality dilemma. To achieve it, you need solid use cases that convince both consumers and retailers that there is added value.” If this is the case, the PwC study suggests that 41 percent of German citizens could see themselves solely using their smartphones to make payments in the future – provided that the method is secure and widely accepted.

Despite all these points, modern payment methods are slowly being accepted in German payment routines. According to the PwC study, smartphones and tablets are especially popular with the younger generation. Forty-six percent of Germans under 30 use mobile payment options; that number only amounts to 12 percent for those over 60. Across all age categories, 25 percent say they occasionally use a smartphone or tablet to make payments. Fifty-seven percent can see themselves using their mobile devices to make payments in five years’ time.

Without wanting to rate a “cashless society” as good or bad, Jacob underscores: “A cashless society is more efficient when it comes to taxes, for example. In Sweden, tax deductions for domestic services can be taken in real time at the time of payment. That’s why it make sense for consumers to make electronic payments or pay by card for these services. The scheme allowed the country to address unreported earnings and black-market work. This provides instant tax transparency.” He can also see this as an option in Germany. Maybe five years from now? “I think we can and will move in that direction. It’s a trend that has also been accelerated by the shock of the COVID crisis. Still, it’s a change in society as a whole that only happens gradually. I expect this development to take 15 rather than five years.”